Bitcoin and Stablecoins Rise as Inflation Soars: Seeking Shelter in Cryptocurrency

Global Trend: Inflation-Stricken Nations Turn to Digital Assets for Stability

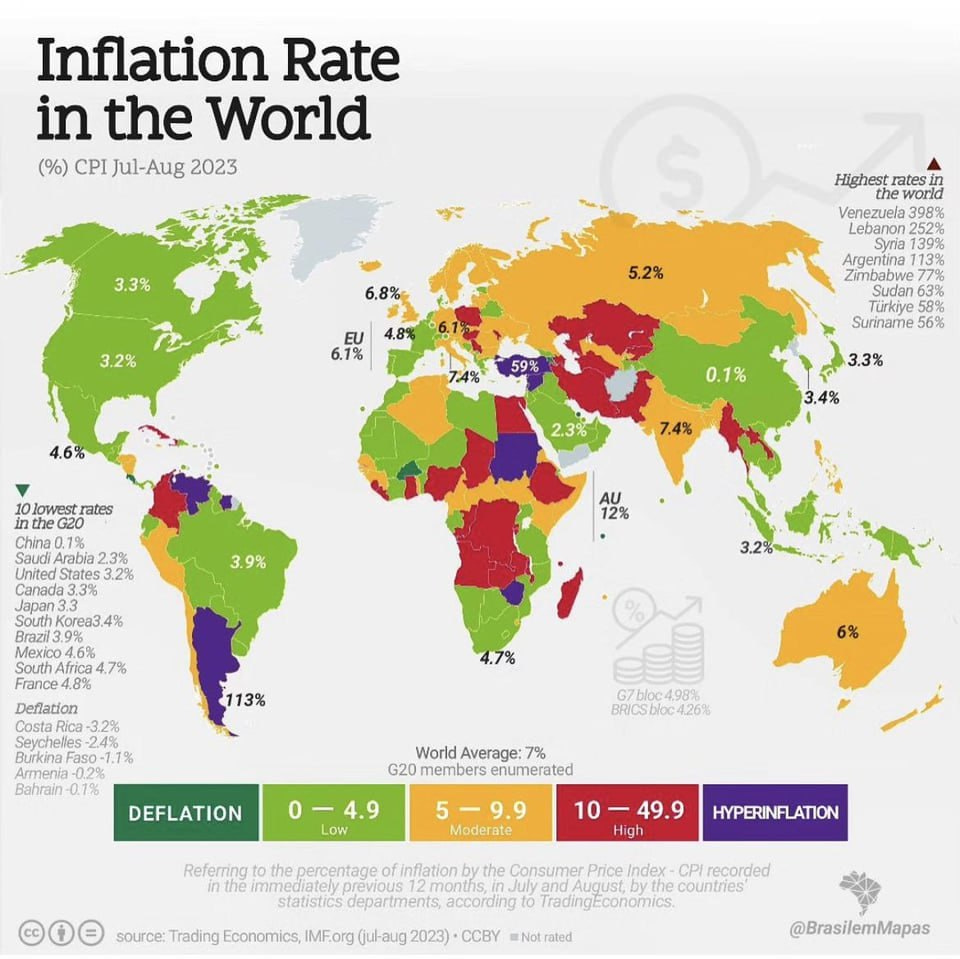

Inflation, the silent eroder of purchasing power, has been making headlines worldwide. Countries such as Argentina, with an inflation rate of a staggering 113%, and Turkey, at 59%, are grappling with economic instability. In such turbulent times, the allure of Bitcoin and stablecoins as stores of value is stronger than ever, offering hope to populations seeking refuge from the ravages of inflation.

Rising Inflation Spurs Crypto Adoption

Inflation, the relentless devaluation of a nation's currency, can have dire consequences for ordinary citizens. As prices soar and savings erode, people are driven to seek alternative assets that can preserve their wealth. In countries like Argentina and Turkey, where inflation rates have reached alarming heights, the appeal of cryptocurrencies like Bitcoin and stablecoins is undeniable.

Bitcoin, with its finite supply and decentralized nature, presents itself as a hedge against inflation. Its scarcity, often likened to digital gold, makes it an attractive option for individuals and businesses alike. Similarly, stablecoins, which are pegged to stable assets like the US dollar, provide a reliable store of value in times of economic turmoil.

Milton Friedman's Wisdom on Inflation

Milton Friedman, the renowned economist, once famously likened inflation to alcohol. He said, "Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output." This analogy holds true, as inflation often begins with a sense of euphoria, where increased money supply seems to fuel economic growth. However, much like alcohol, the hangover of inflation sets in later, as the cost of living rises and savings lose their value.

As countries grapple with skyrocketing inflation rates, many are experiencing the "hangover" phase of Friedman's analogy. In their quest for a stable store of value, they turn to cryptocurrencies and stablecoins as a means of protection against further devaluation of their local currencies.

The Global Trend Towards Crypto

The global trend of seeking refuge in cryptocurrencies and stablecoins during times of inflation is not limited to specific regions. It reflects a broader shift in the perception of these digital assets as legitimate alternatives to traditional fiat currencies.

While Bitcoin and stablecoins offer potential solutions for preserving wealth in the face of inflation, they are not without risks and challenges. Regulatory concerns, price volatility, and technological barriers are among the factors that individuals and governments must consider.

In conclusion, the surge in inflation rates worldwide, particularly in countries like Argentina and Turkey, has intensified the search for stable stores of value. Bitcoin and stablecoins have emerged as viable options, aligning with Milton Friedman's analogy of inflation as a monetary phenomenon that brings euphoria before the inevitable hangover. Whether these digital assets can provide a lasting solution to the economic challenges posed by inflation remains a topic of debate, but their popularity in such trying times is indisputable.