Solana's Precarious Edge: FTX's $1 Billion Liquidation Looms

FTX Bankruptcy

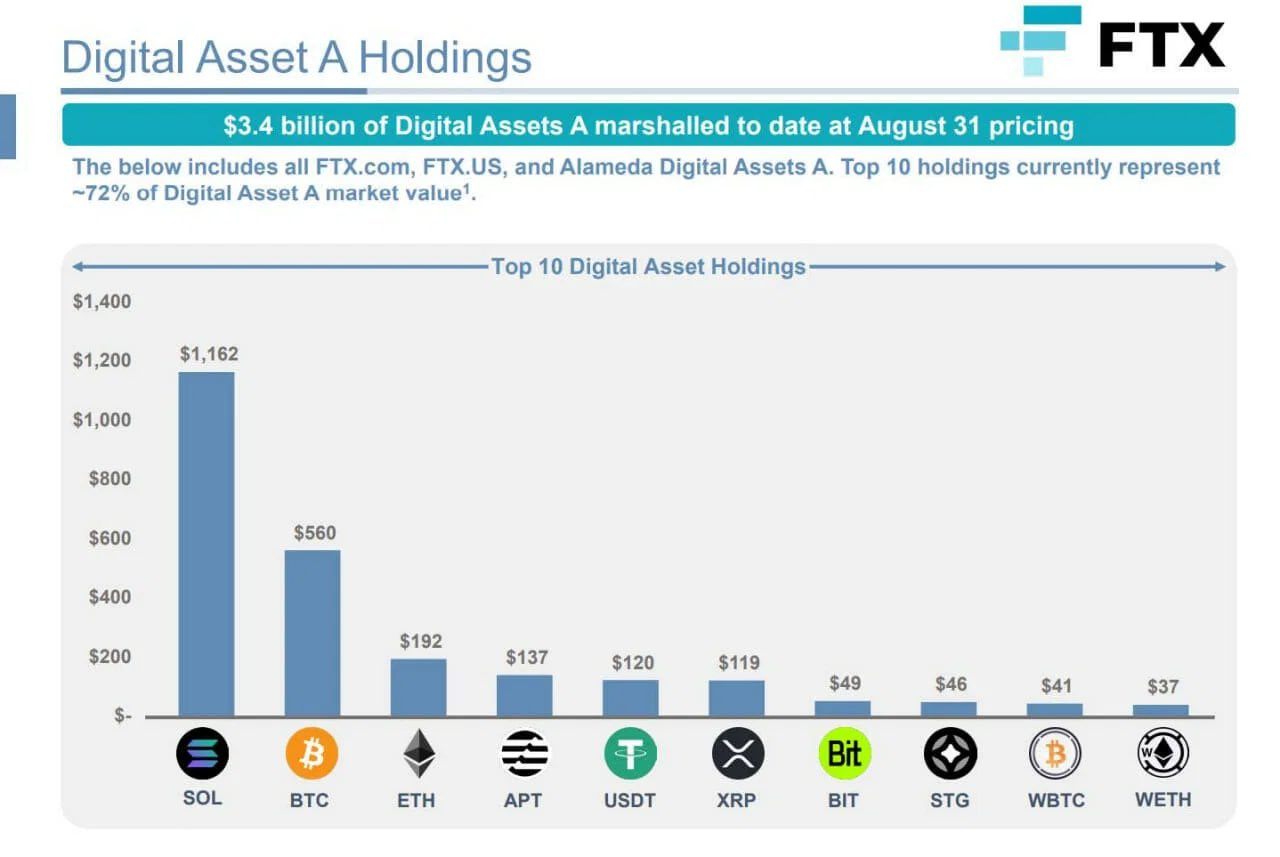

In the world of cryptocurrency, FTX was once a prominent name, founded by the enigmatic Sam Bankman-Fried. However, recent financial woes have pushed the exchange into bankruptcy proceedings. What's astonishing is that despite its financial turmoil, FTX still holds a staggering $3.4 billion in assets. This includes a hefty stash of over $1 billion in Solana, a cryptocurrency with a daily trading volume of approximately $300 million. The implications of liquidating such a substantial Solana position could send shockwaves through the market.

The $1 Billion Solana Dilemma

Solana, a blockchain platform known for its speed and scalability, has gained considerable attention in recent years. However, the daily trading volume of Solana hovers around $300 million, a mere fraction of FTX's $1 billion holdings. Liquidating such a substantial amount of Solana at once would undoubtedly exert immense downward pressure on its price. The ensuing panic among investors could trigger a domino effect, causing a significant crash in Solana's value.

FTX's predicament raises a crucial question: How will they manage this massive Solana position during bankruptcy proceedings? The process of liquidation must be carefully strategized to minimize the impact on the cryptocurrency's market price. FTX's actions in this regard will undoubtedly be closely scrutinized by the crypto community.

Bitcoin Holdings: A Relative Stability

In addition to its Solana holdings, FTX still possesses approximately $560 million worth of Bitcoin. While this is a substantial amount, the sheer liquidity and trading volume of Bitcoin make it less susceptible to drastic price fluctuations due to a sell-off. Bitcoin consistently maintains a high daily trading volume, often exceeding tens of billions of dollars. Therefore, liquidating its Bitcoin holdings would likely not have a pronounced effect on the cryptocurrency's market price.

The Broader Implications

The FTX bankruptcy case underscores the challenges faced by cryptocurrency exchanges, especially when dealing with substantial holdings of lesser-known assets. It highlights the need for responsible and thoughtful management of assets during bankruptcy proceedings in the crypto space.

Additionally, it serves as a reminder of the inherent risks in the cryptocurrency market, where asset values can be extremely volatile. Large asset positions, such as FTX's $1 billion in Solana, can quickly become problematic if not managed prudently. The fate of FTX's holdings and how they navigate these treacherous waters will be a topic of great interest to crypto enthusiasts and industry observers alike.

In conclusion, FTX's bankruptcy situation is a stark reminder that even in the world of cryptocurrencies, financial troubles can arise, and the management of assets during such times is critical. The $1 billion Solana holding represents a particularly precarious situation, given the cryptocurrency's relatively modest daily trading volume. How FTX handles this dilemma will undoubtedly be a case study in crypto market dynamics and responsible asset management during challenging times.