The Bitcoin Halving

Unveiling Its Impact on Miners and the Cryptocurrency Industry

The Bitcoin halving, a significant event that occurs approximately every four years, has captivated the attention of the cryptocurrency community and investors worldwide. As an essential part of Bitcoin's monetary policy, the halving has profound implications for miners and the entire cryptocurrency industry. In this article, we will explore what the Bitcoin halving entails, its effects on miners, and its broader influence on the crypto ecosystem.

Understanding the Bitcoin Halving:

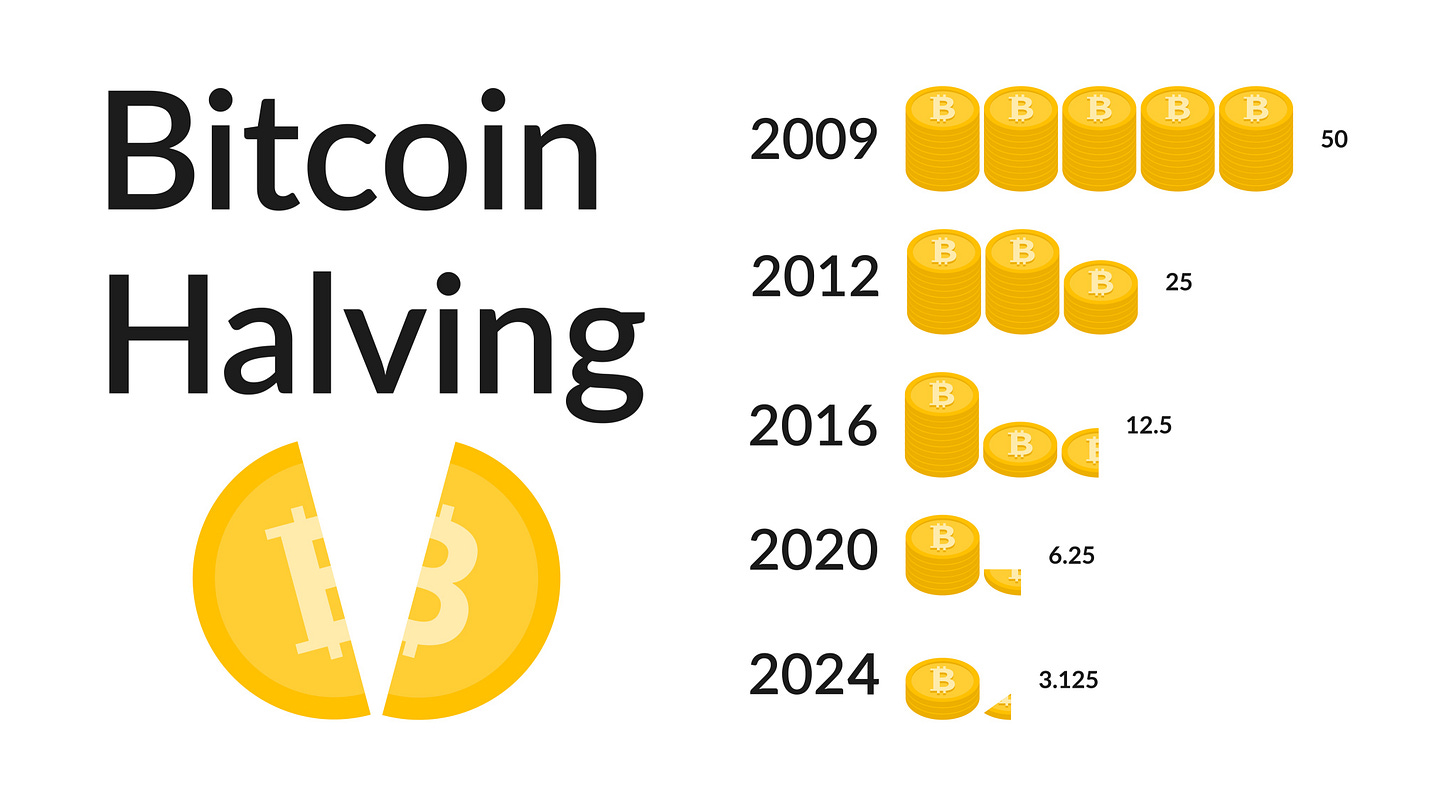

The Bitcoin halving is a pre-programmed event that happens after every 210,000 blocks are mined, which occurs roughly every four years. During this event, the block reward that miners receive for successfully validating transactions and adding them to the blockchain is reduced by half. The initial block reward, set at 50 BTC, has undergone two halvings, resulting in the current block reward of 6.25 BTC.

Implications for Bitcoin Miners:

The halving has significant implications for Bitcoin miners:

Reduced Block Rewards: Following each halving, miners receive half the number of new Bitcoins for their mining efforts. This reduction in block rewards directly impacts miners' revenue and profitability.

Increased Competition: With reduced rewards, mining becomes less financially rewarding for some miners. This can lead to a drop in mining activity, reducing the network's hashrate and potentially making it easier for other miners to compete.

Economic Incentives: The halving serves as an integral component of Bitcoin's deflationary monetary policy, reducing the rate at which new Bitcoins are created and creating scarcity. As the block rewards diminish over time, the limited supply is expected to contribute to Bitcoin's long-term value appreciation.

Mining Difficulty Adjustment:

To maintain a consistent block creation time of approximately 10 minutes, the Bitcoin protocol automatically adjusts the mining difficulty. As miners leave or join the network after each halving, the difficulty is recalibrated to ensure a stable mining rate.

Evolving Industry Landscape:

The Bitcoin halving reverberates across the entire cryptocurrency industry:

Market Sentiment: The halving event often sparks heightened market speculation and interest, leading to increased volatility in the price of Bitcoin. In the past, halving events have been associated with bull markets.

Mining Hardware Innovation: Miners may seek to upgrade their mining hardware to improve efficiency and hash power, enabling them to remain competitive in the post-halving landscape.

Shift in Mining Pools: With reduced profitability for individual miners, there may be a shift towards mining pools, where miners combine their resources to share rewards more evenly.

Conclusion:

The Bitcoin halving is a crucial aspect of the cryptocurrency's monetary policy, setting it apart from traditional fiat currencies. As each halving event occurs, miners face reduced block rewards, challenging their profitability and increasing competition. However, the halving also contributes to Bitcoin's scarcity and potential value appreciation over time.

While the Bitcoin halving introduces short-term uncertainties, it reinforces the network's long-term stability and deflationary nature. As the cryptocurrency industry continues to evolve, miners and market participants must adapt to the changing landscape, fostering innovation and ensuring the sustainability of the Bitcoin network.